Transactions

Reliance helps clients on a range of equity and debt transactions, including mergers and acquisitions, public offers and defenses in connection with unsolicited acquisition proposals and tender offers, as well as ECM & DCM transactions, including IPOs, secondary offerings, placements, and other situations.

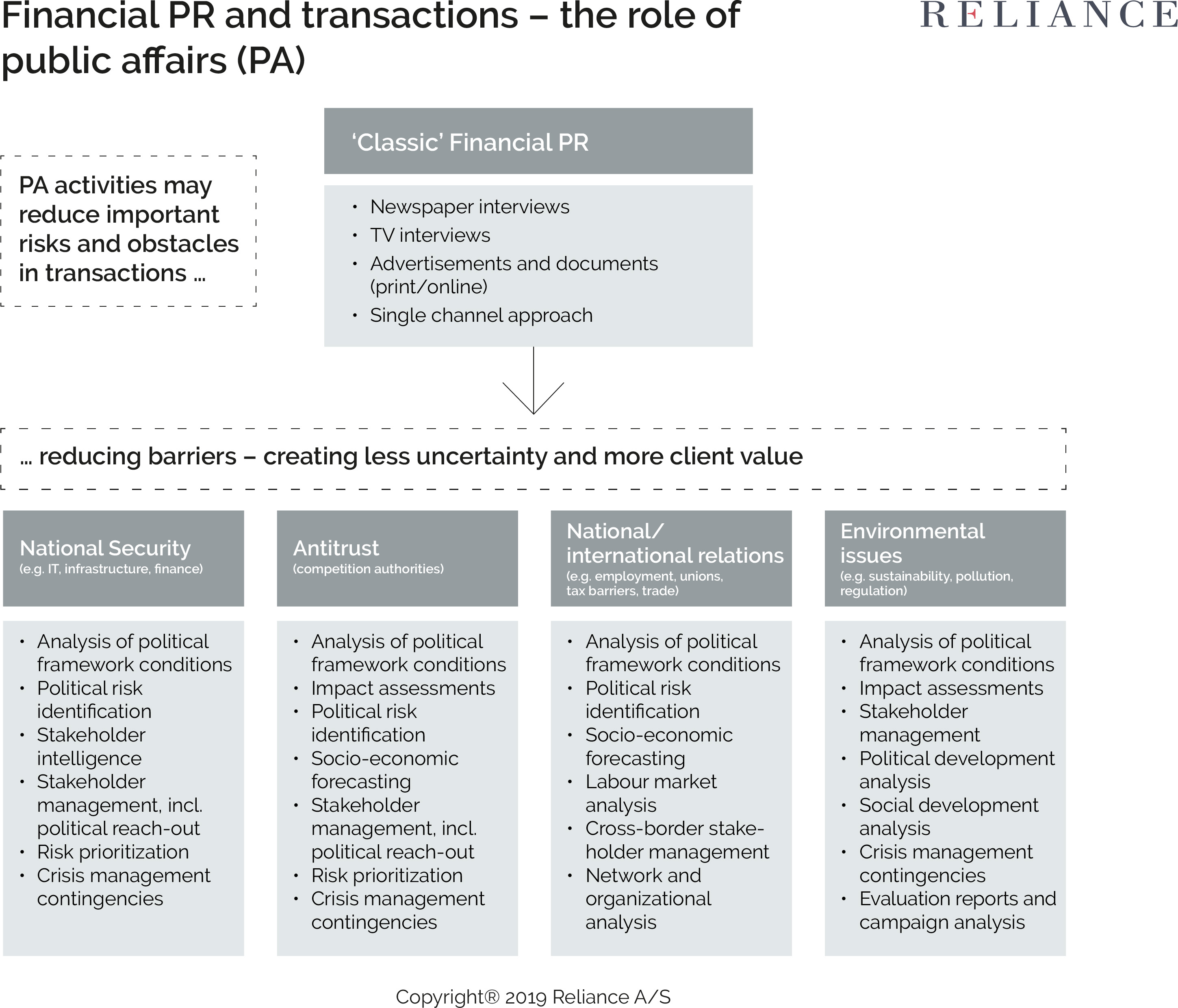

We help clients develop effective communications strategies aimed at generating broad-based understanding of, and support for, the value proposition underpinning a transaction. We identify and engage key stakeholders around our clients’ defined strategic vision and path to growth through M&A, while simultaneously pre-empting and overcoming potential challenges.

> View more

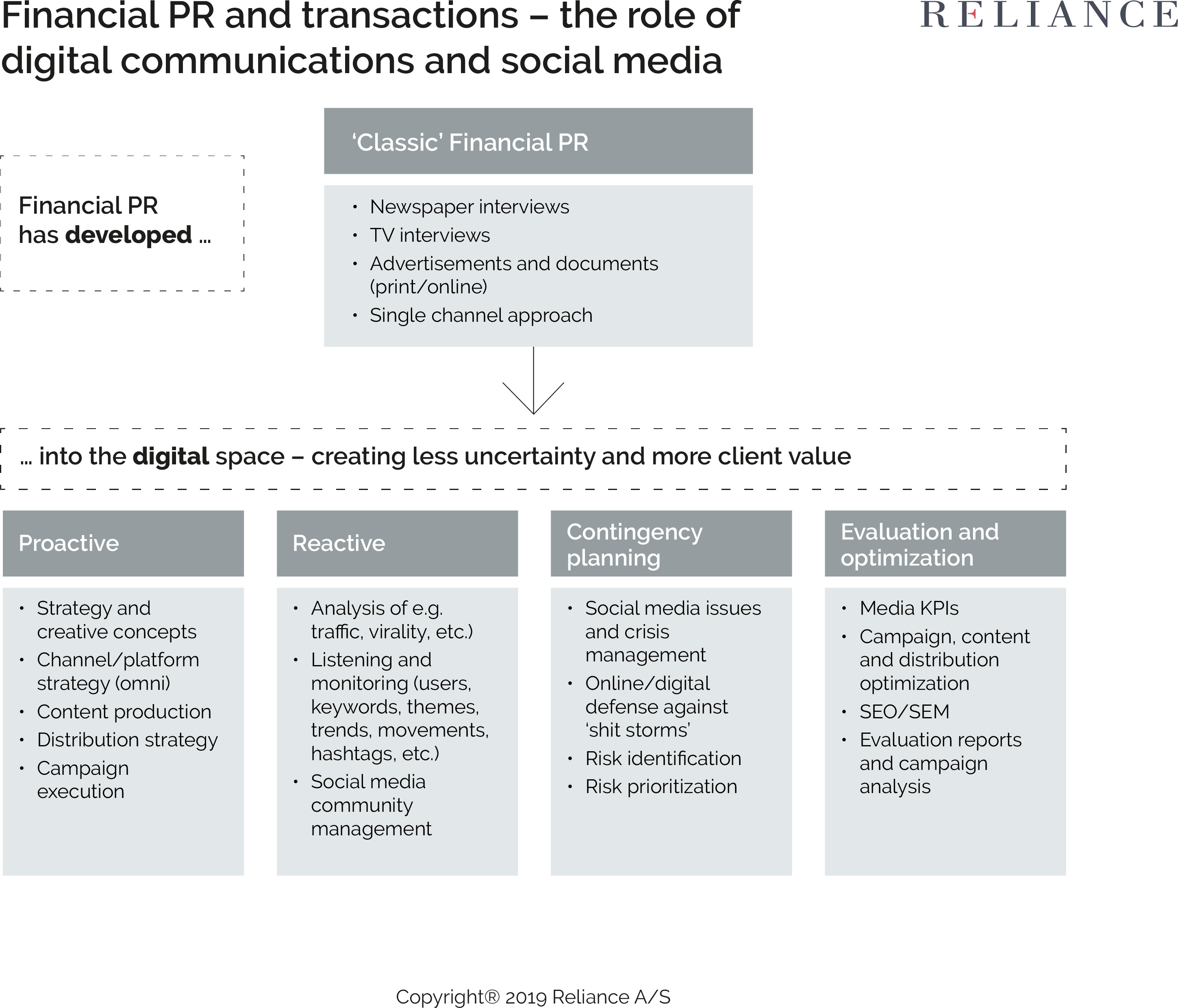

We assist and provide strategic advice within message development, media relations, preparing communications materials, creating IPO & M&A websites and announcement advertising, preparing and implementing digital & social media strategies, and coordinate the logistics related to announcements. When needed, we involve our public affairs team in the event of e.g. regulatory issues. Post announcement, we assist clients throughout the integration and approval process in order to track messaging and communicate effectively to all critical stakeholders.

We mantain relationships with relevant stakeholders specializing in IPOs and M&A, including investment banks, law firms and financial journalists. Our international experience and extensive international network is essential when assisting in cross-border transactions.

> View less

At Reliance, we help clients maximize the impact of M&A transactions and obtain critical support from stakeholders. Reliance takes a campaign approach to IPO and M&A communications. Regardless of transaction size or level of complexity, we deliver innovative, best practice IPO and M&A communication strategies and execution to our clients. This is backed by our deep insight and experience in the transactions area, including from our past roles as e.g. heads of IR, senior equity analysts, senior investment bankers and financial journalists. Hence, we understand the key stakeholders and how to optimize our clients’ interest, position and reputation among these stakeholders.

“We help clients maximize the impact of M&A transactions and obtain critical support from relevant stakeholders”