Alternative Investment Firms

Building and maintaining a strong corporate reputation is critical to any investor’s or financial institution’s license to operate. Reliance has extensive experience from advising alternative investment firms, including private equity funds, venture capital funds, infrastructure funds/investors, hedge funds and asset management funds and firms.

Some firms choose to be highly visible while others prefer no public attention. However, it is critical for such firms to manage and actively think about their communications profile in the media and with the important audiences. Reliance advises on developing of programs to build and maintain investment firms’ reputations and helps them achieve their business objectives, e.g. strengthening deal flow, increasing awareness within the institutional investor community, supporting investment activities, or recruiting outstanding professionals.

In particular, private equity funds may be exposed to unknown reputational risks, inherent to their portfolio companies. Reliance helps to audit, identify and assess communications-related risks, which in turn enables management to better protect the company’s reputation.

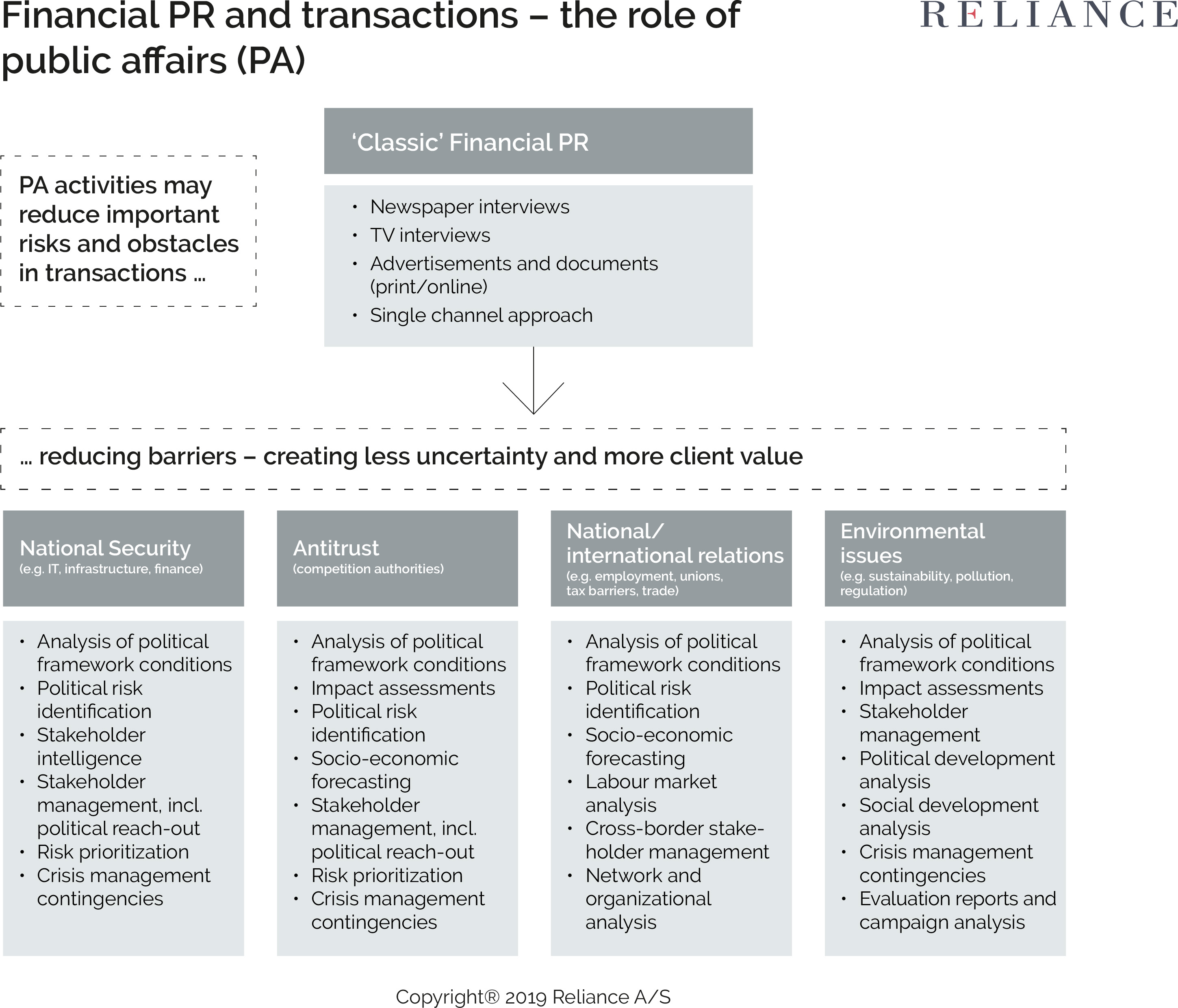

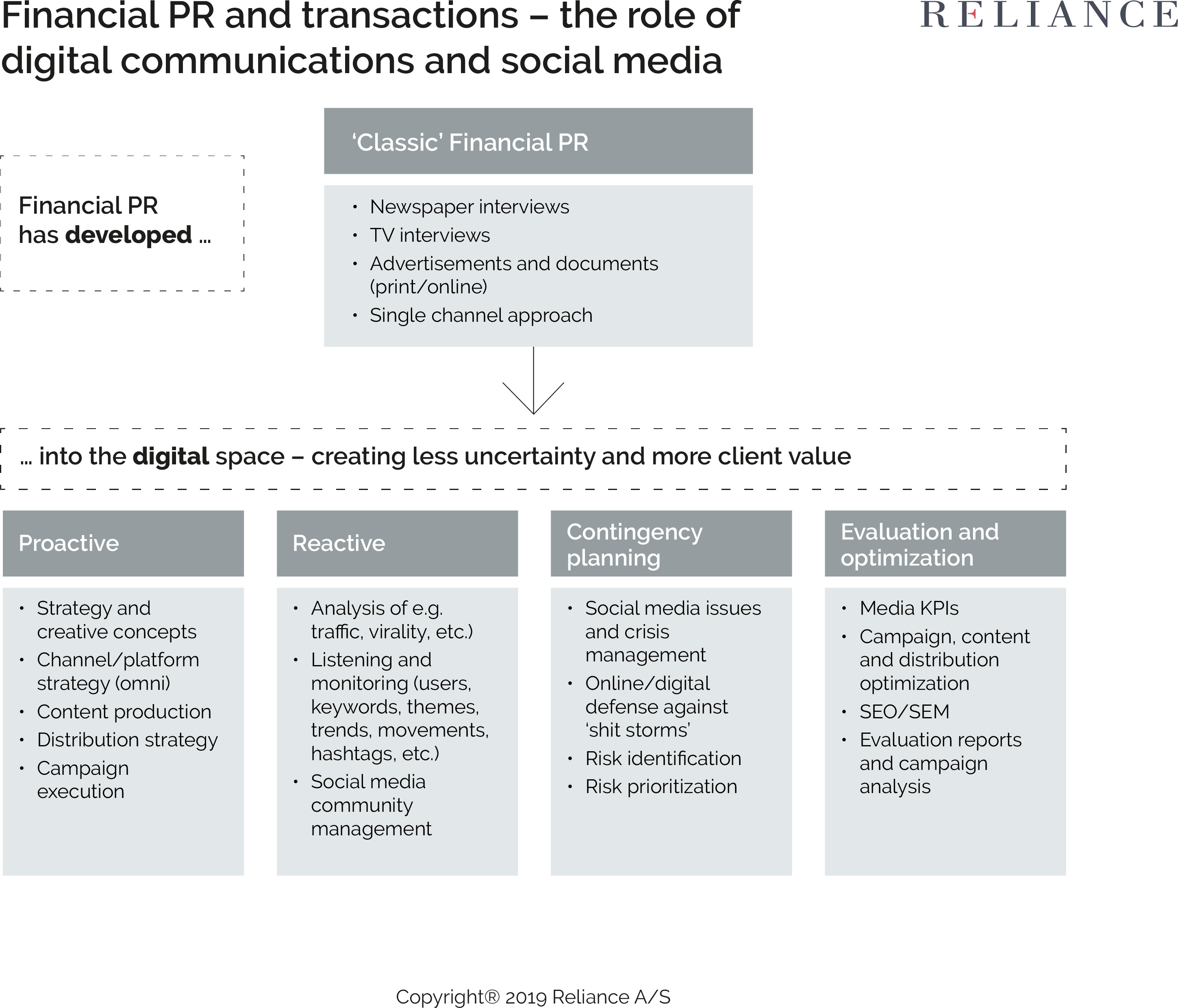

At Reliance, we help clients on media relations and financial PR in connection with e.g. M&A transactions and IPOs, public takeovers, public offers, P2Ps (public-to-private), pre-exit communications, shareholder activism, fundraising, increase AUM, and advise on communications for events such as restructurings, refinancing, management changes, financial performance issues, regulatory investigations and crises.

“Building and maintaining a strong corporate reputation is critical to any investor’s or financial institution’s license to operate”